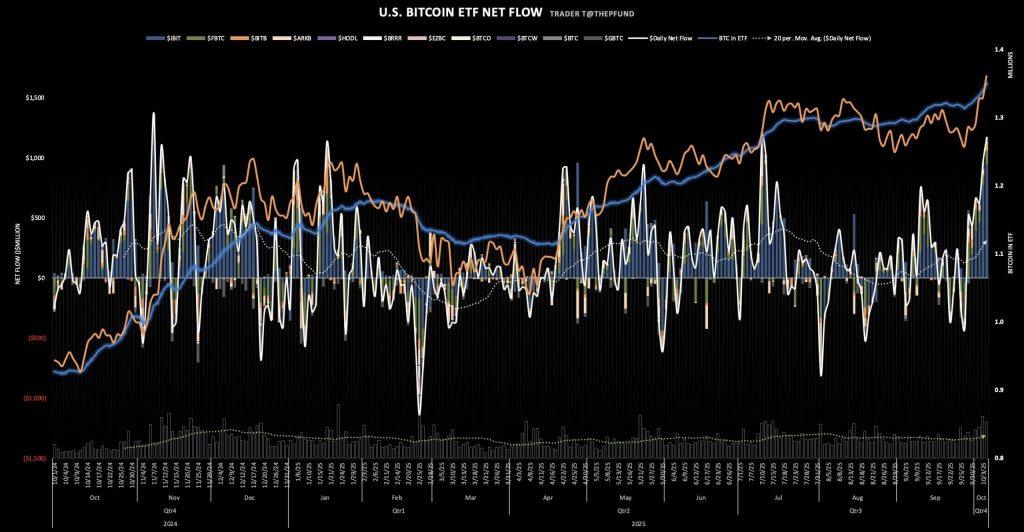

Investor activity in US-listed spot Bitcoin exchange-traded funds (ETFs) surged sharply on Oct. 6, mirroring BTC’s continued price gains and growing institutional interest.

According to data from SoSoValue, the twelve approved funds collectively absorbed about $1.2 billion in inflows. This is their second-largest single-day haul since launching in 2024 and the strongest performance this year.

Much of that demand concentrated around BlackRock’s iShares Bitcoin Trust (IBIT), which pulled in nearly $967 million in fresh capital and nearly $5 billion in trading volume.

IBIT is now on the verge of crossing the $100 billion assets-under-management threshold, an unprecedented milestone for a digital-asset product.

Bloomberg analyst Eric Balchunas noted that IBIT has already produced an estimated $244 million in annual revenue for BlackRock, surpassing the earnings of the firm’s other long-established funds.

That profitability reflects how deeply institutional money has begun to integrate Bitcoin into mainstream portfolio strategies.

Meanwhile, the latest wave of inflows extends a broader pattern of strength that the financial investment vehicles have registered recently.

Last week alone, Bitcoin ETFs attracted around $3.2 billion in net new capital, marking the second-highest inflow on record.

The post Bitcoin ETFs see record $1.2 billion inflow with BlackRock’s IBIT leading the charge appeared first on CryptoSlate.